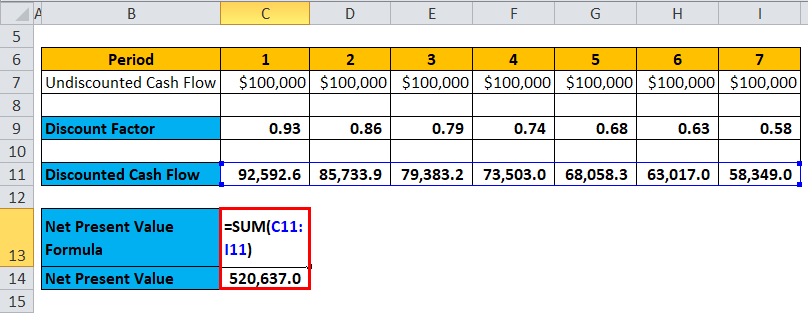

The act of discounting future cash flows asks "how much money would have to be invested currently, at a given rate of return, to yield the forecast cash flow, at its future date?" In other words, discounting returns the present value of future cash flows, where the rate used is the cost of capital that appropriately reflects the risk, and timing, of the cash flows. The discounted cash flow formula is derived from the present value formula for calculating the time value of money D C F = C F 1 ( 1 + r ) 1 + C F 2 ( 1 + r ) 2 + ⋯ + C F n ( 1 + r ) n. Irving Fisher in his 1930 book The Theory of Interest and John Burr Williams's 1938 text The Theory of Investment Value first formally expressed the DCF method in modern economic terms. Following the stock market crash of 1929, discounted cash flow analysis gained popularity as a valuation method for stocks. ĭiscounted cash flow valuation is differentiated from the accounting book value, which is based on the amount paid for the asset. Modern discounted cash flow analysis has been used since at least the early 1700s in the UK coal industry. Studies of ancient Egyptian and Babylonian mathematics suggest that they used techniques similar to discounting future cash flows. The opposite process takes cash flows and a price (present value) as inputs, and provides as output the discount rate this is used in bond markets to obtain the yield.ĭiscounted cash flow calculations have been used in some form since money was first lent at interest in ancient times. Using DCF analysis to compute the NPV takes as input cash flows and a discount rate and gives as output a present value. The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question įor further context see Valuation (finance) § Valuation overview Īnd for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and venture capital, corporate finance "projects", and mergers and acquisitions. To apply the method, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs).

#Calculating discounted cash flow free#

Here, a spreadsheet valuation, uses Free cash flows to estimate stock's Fair Value and measure the sensitivity of WACC and Perpetual growth

courts began employing the concept in the 1980s and 1990s. Used in industry as early as the 1700s or 1800s, it was widely discussed in financial economics in the 1960s, and U.S. The discounted cash flow ( DCF) analysis, in finance, is a method used to value a security, project, company, or asset, that incorporates the time value of money.ĭiscounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. ( Learn how and when to remove this template message)

JSTOR ( January 2010) ( Learn how and when to remove this template message).Unsourced material may be challenged and removed.įind sources: "Discounted cash flow" – news Please help improve this article by adding citations to reliable sources.

This article needs additional citations for verification.

0 kommentar(er)

0 kommentar(er)